Rich Dad Poor Dad: Lessons on Building Wealth and Financial Freedom

“Rich Dad Poor Dad” by Robert Kiyosaki is one of the most influential personal finance books of all time. It teaches fundamental lessons about money, wealth creation, and financial independence through a simple yet powerful narrative. Kiyosaki tells his story growing up with two father figures: his biological father—the “poor dad,” who valued job security and conventional education—and his best friend’s father—the “rich dad,” who understood money, investing, and building assets.

This article rephrases the story and shares the core lessons that can help anyone improve their financial life.

Two Fathers, Two Mindsets

Robert Kiyosaki grew up observing two very different approaches to money:

- Poor Dad: Highly educated, with a stable job, believed in working hard, saving, and climbing the corporate ladder. He thought financial security came from a good salary and pensions.

- Rich Dad: Less formally educated, but financially wise, an entrepreneur who understood how money works. He believed in building assets, taking calculated risks, and learning to make money work for you.

The contrast between these two philosophies shaped Kiyosaki’s approach to wealth and investing.

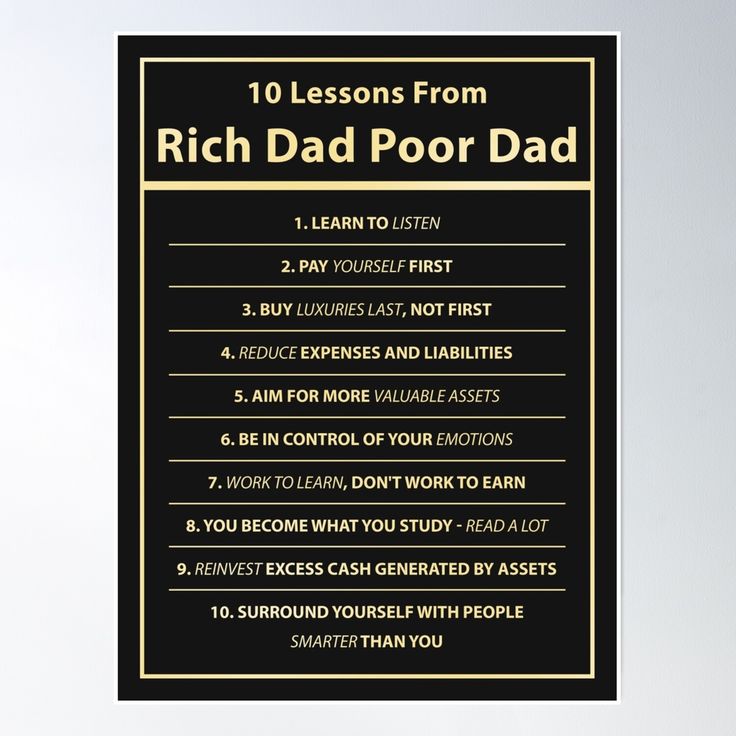

Lesson 1: The Importance of Financial Education

One of the biggest takeaways from Rich Dad Poor Dad is that financial education is critical. Schools teach academic subjects but rarely teach how to handle money, invest, or grow wealth.

Kiyosaki learned from his “rich dad” that understanding concepts like assets, liabilities, cash flow, and investments is far more valuable than merely earning a high income. The key is knowing the difference between assets (things that put money in your pocket) and liabilities (things that take money out).

Real-Life Insight:

Many middle-class families focus on buying a bigger house or luxury car, thinking they are wealth-building. In reality, these are often liabilities. Financial education teaches you to acquire assets that generate passive income.

Lesson 2: Assets vs Liabilities

Rich dad taught Kiyosaki that the path to wealth is accumulating assets. He defined assets as investments or properties that generate income—like stocks, real estate, or businesses. Liabilities, on the other hand, drain your money, such as loans, credit card debt, or expensive cars that depreciate.

Key Takeaway:

- Poor Dad: Works to pay off liabilities.

- Rich Dad: Works to acquire assets that create passive income.

The lesson is clear: focus on acquiring assets, not liabilities, to achieve financial freedom.

Lesson 3: Make Money Work for You

A core idea in the book is that earning a salary is not enough. Working for money alone limits your financial growth. Rich dad taught that the rich make money work for them through investments, business, and financial strategies.

Instead of trading time for money, smart investors focus on creating passive income streams—income that continues even when you are not actively working. Examples include dividends from stocks, rental income from properties, and profits from businesses.

Lesson 4: The Power of Entrepreneurship

Kiyosaki emphasizes that entrepreneurship is a key driver of wealth. While traditional employment offers stability, it rarely leads to financial freedom. Entrepreneurs take calculated risks, build businesses, and leverage opportunities to generate wealth.

Rich dad’s philosophy encourages thinking beyond a 9-to-5 job. He believed that true financial independence comes from owning systems and assets that generate money independently of your labor.

Lesson 5: Overcoming Fear and Taking Risks

One reason many people fail to build wealth is fear of losing money. Poor dad believed in playing it safe—avoiding risks, keeping money in a savings account, and fearing financial failure.

Rich dad taught Kiyosaki that fear and lack of financial knowledge keep people trapped in mediocrity. Wealthy individuals understand calculated risk: they invest in opportunities after studying them, learning from mistakes, and continuously improving their skills.

Real-Life Example:

Consider entrepreneurs like Ratan Tata or Rakesh Jhunjhunwala, who took calculated risks in business and investment. Without taking those risks, their financial growth would have been limited.

Lesson 6: Mind Your Own Business

Rich dad advised that everyone should mind their own business, meaning focus on building and managing your assets instead of only working for someone else.

Many people spend decades climbing the corporate ladder, increasing their income but not their wealth. Rich dad’s advice is to focus on:

- Building investments

- Expanding knowledge

- Creating additional streams of income

The principle is simple: your financial success depends on your ability to grow your assets, not just your salary.

Lesson 7: Taxes and Corporations

Kiyosaki highlights that understanding taxes and corporations is vital for wealth-building. Rich people often use corporations, deductions, and legal financial structures to reduce tax liabilities and reinvest profits.

Poor dad, focused on salary, paid high taxes and never leveraged tax strategies. Learning the rules of the financial system gives you an advantage in accumulating wealth.

Lesson 8: Work to Learn, Not Just for Money

Rich dad emphasized learning multiple skills: investing, marketing, sales, communication, and management. Kiyosaki observed that knowledge of money and business is more valuable than academic degrees in building wealth.

Real-Life Insight:

Even high-earning professionals can struggle financially if they lack financial literacy. Learning how money works allows you to multiply income and build assets efficiently.

Lesson 9: Start Early and Think Long-Term

Time is your greatest asset. Kiyosaki’s rich dad advised starting investments early, leveraging compounding and long-term thinking.

The earlier you begin financial planning, the more freedom you have to take risks and grow wealth. Waiting too long or relying solely on a salary can limit your ability to achieve financial independence.

Lesson 10: The Mindset Difference

Ultimately, the book teaches that wealth begins in the mind. Poor dad viewed money as a source of stress; rich dad viewed it as a tool for opportunity.

- Poor Dad Mindset: Security, risk-averse, dependent on salary

- Rich Dad Mindset: Opportunity, risk-managed, focused on assets and cash flow

Shifting your mindset from scarcity to abundance is the first step toward financial freedom.

Real-Life Applications

Many ordinary people in India and around the world have applied Kiyosaki’s principles:

- Salaried professionals investing in real estate and mutual funds to generate passive income.

- Entrepreneurs building small businesses that grow into multi-crore ventures.

- Investors studying markets, acquiring assets, and minimizing liabilities to build wealth over decades.

These examples show that financial literacy, discipline, and a mindset shift can transform your life, even if you start with limited resources.

Final Thoughts

“Rich Dad Poor Dad” is more than a story—it’s a financial blueprint. It teaches that wealth is not about how much you earn, but how wisely you manage and grow your money.

Key takeaways:

- Focus on assets, not liabilities

- Let money work for you

- Invest in financial education

- Take calculated risks

- Start early and stay consistent

By rethinking money, embracing the rich dad mindset, and applying these principles in real life, anyone can move toward financial freedom and long-term wealth.

Remember: it’s never too late to start, and small, consistent actions today can create a rich future tomorrow.

🔹 FAQs for SEO

Q1. What is the main lesson of Rich Dad Poor Dad?

The book teaches that financial freedom comes from building assets, investing wisely, and letting money work for you, rather than relying solely on a salary.

Q2. How does Rich Dad Poor Dad define assets and liabilities?

Assets generate income, such as investments, real estate, and businesses. Liabilities drain money, like loans, expensive cars, or consumer debt.

Q3. Can ordinary people apply Rich Dad Poor Dad principles?

Yes. By focusing on financial education, acquiring assets, and taking calculated risks, anyone can improve wealth over time.

Q4. Why is financial education more important than traditional education?

Schools often teach academic subjects but rarely teach money management, investing, or wealth-building, which are essential for financial independence.

Q5. How important is starting early according to Rich Dad Poor Dad?

Starting early allows compounding to work over decades, increasing wealth significantly and reducing the amount needed to reach financial freedom.

Q6. What mindset difference does the book highlight?

Poor Dad focuses on security and salary dependence, while Rich Dad focuses on opportunity, assets, and creating passive income streams.

For the Latest Jobs Notifications: Click Here

Join With Us On WhatsApp: Click Here

Join With Us On LinkedIn: Click Here

Free Python Learning: Click Here